Check out our latest updates:

- Fixed assets can now be automatically depreciated

- VAT on imports support is now built in

- We now fill out TSD annex 2

- You can now set credit limit to your clients

- Financial reports can now be compiled for more than one object

- Better overview of payment orders sent to bank

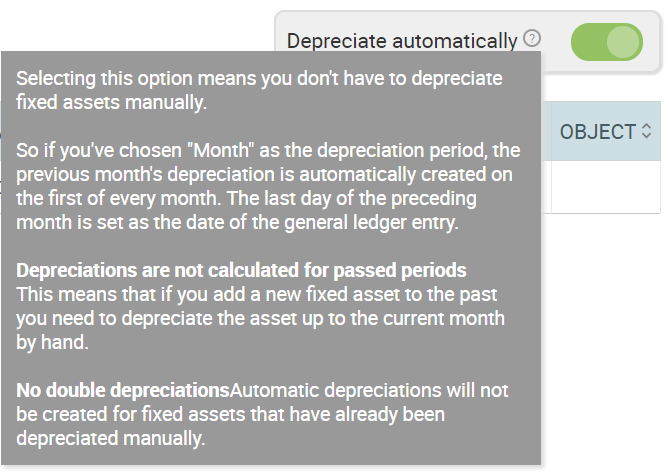

Automatic depreciation of fixed assets

Now you can tell SmartAccounts to create depreciation entries for your fixed assets automatically. To activate this option, please go to ‘Fixed assets’ – ‘Fixed assets’ and activate the option ‘Depreciate automatically’.

SmartAccounts runs automatic calculation at the beginning of every month (if you’ve chosen ‘Month’ as the depreciation period). The last day of the preceding month is set as the date of the general ledger entry.

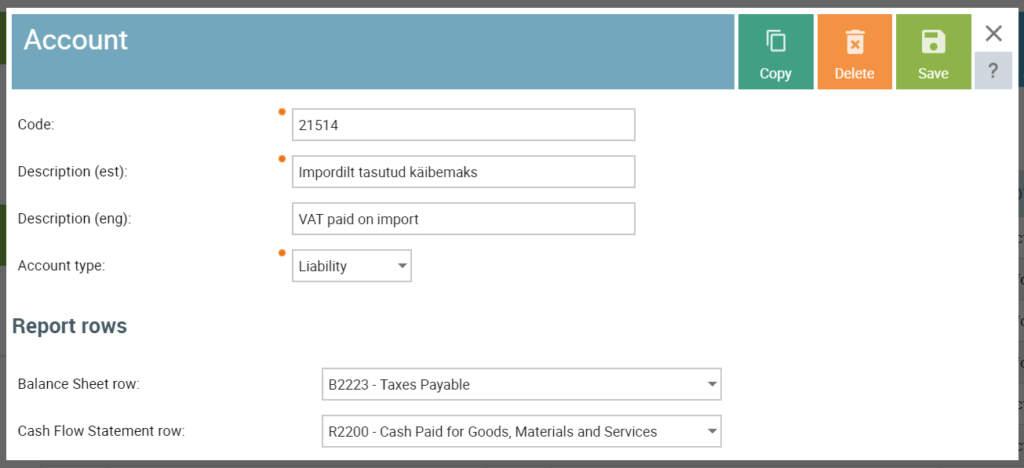

VAT on imports is now built in

If your dealing with importing goods to Estonia you might find the new VAT rate ‘VAT on imports’ really useful. It should be used when paying VAT on importation on the basis of customs declaration to the customs agents.

If you’ve paid value-added tax on imports you normally have a right to deduct it as an input VAT. The sum of the VAT paid on imports will be declared on the Value-Added Tax Return in sections 5 and 5.1.

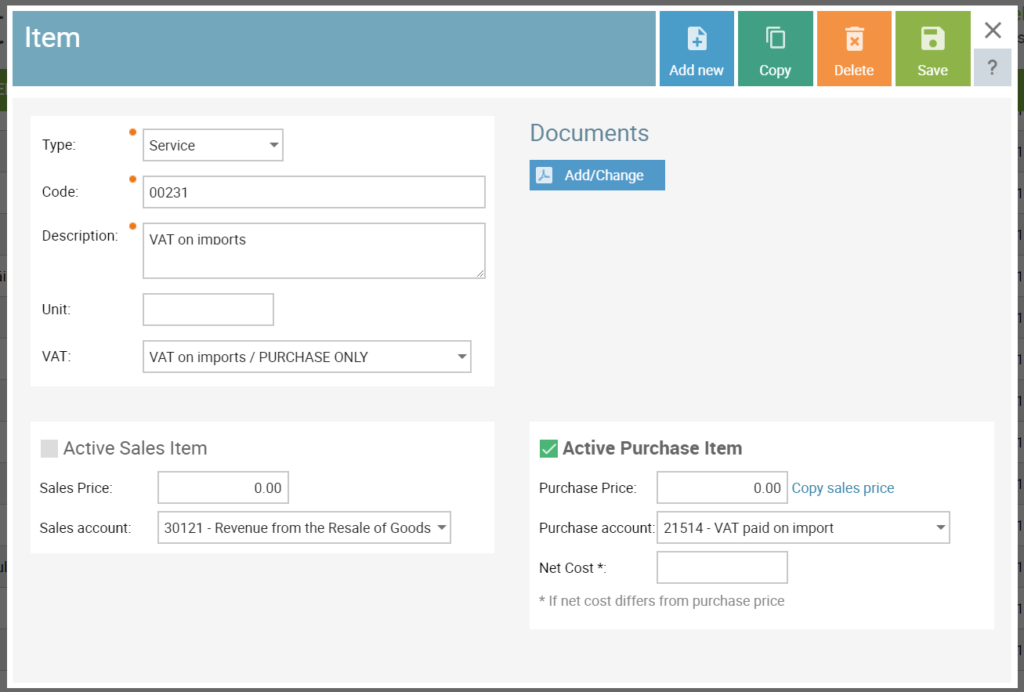

It is advisable to keep records for VAT payable on imports on the separate account (not the default input VAT account), so you should use this VAT rate together with the account ‘VAT paid on import’ and default item ‘VAT on imports’.

If you need to use ‘VAT on import’ please check if you have the appropriate account in the chart of accounts (‘Settings’ – ‘Chart of Accounts’) and an item in the item list (‘Purchase/sales’ – ‘Items’) if not, then please add these.

You start by adding the account in your chart of accounts

When you have the account set up you can now add the item to your purchase item list

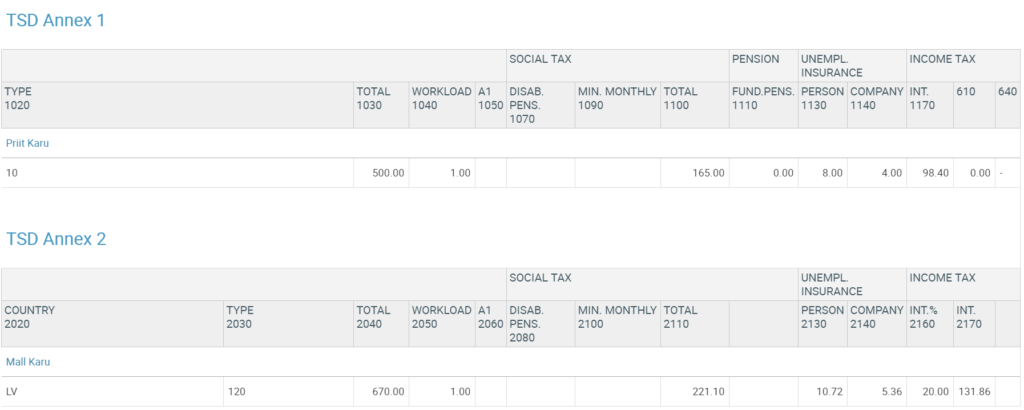

TSD Annex 2 is now filled out

Declaration of payments made to non-residents and associated tax liabilities is now much much easier because SmartAccounts now fills Annex 2 of TSD form for you.

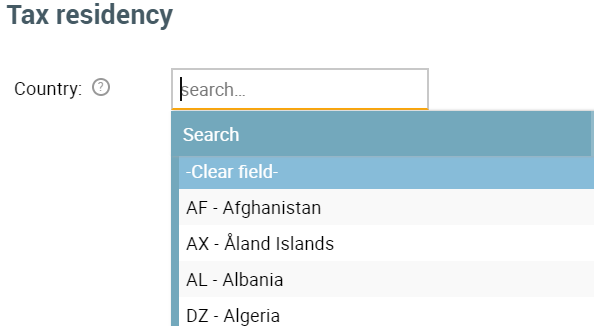

With this new feature we added tax residency country to the employee’s card.

Also new default payout types were created to be used with non-residents:

- Vacation pay (non-resident)

- Employment income (non-resident)

If you have non-resident employees and you’ve made payouts to them the Annex 2 is generated alongside the usual Annex 1.

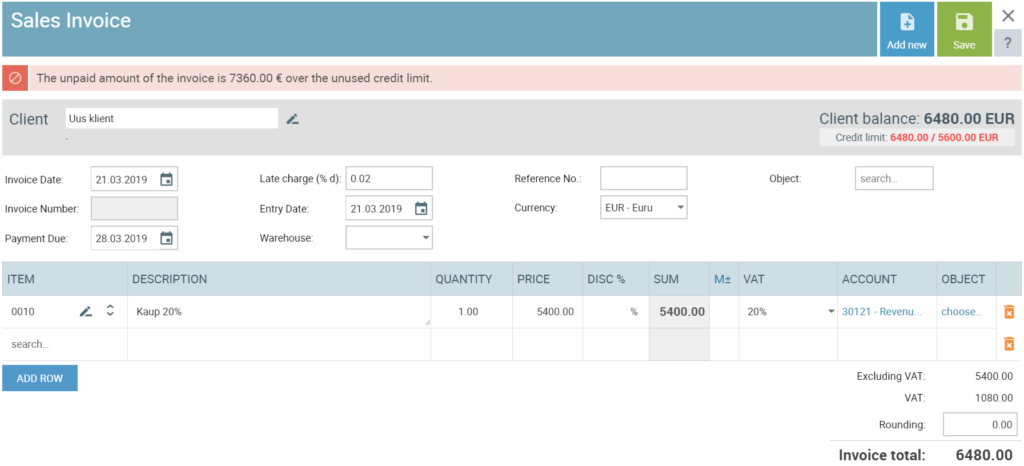

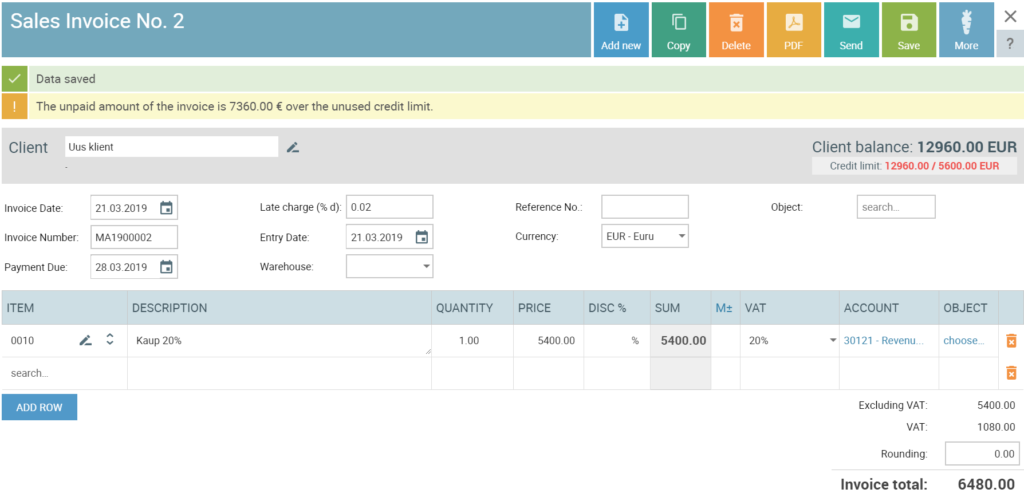

Set credit limit to your clients

We’ve added an option to set credit limit to your clients if you are dealing with credit sales. We’ve also added an option to set the credit limit as strict or flexible.

If you set the credit limit to be strict then you can’t save new invoices if the limit is exceeded.

If the credit limit is set to be non-strict you just get a notification upon saving the invoice but you can still save the invoices and deal with customers.

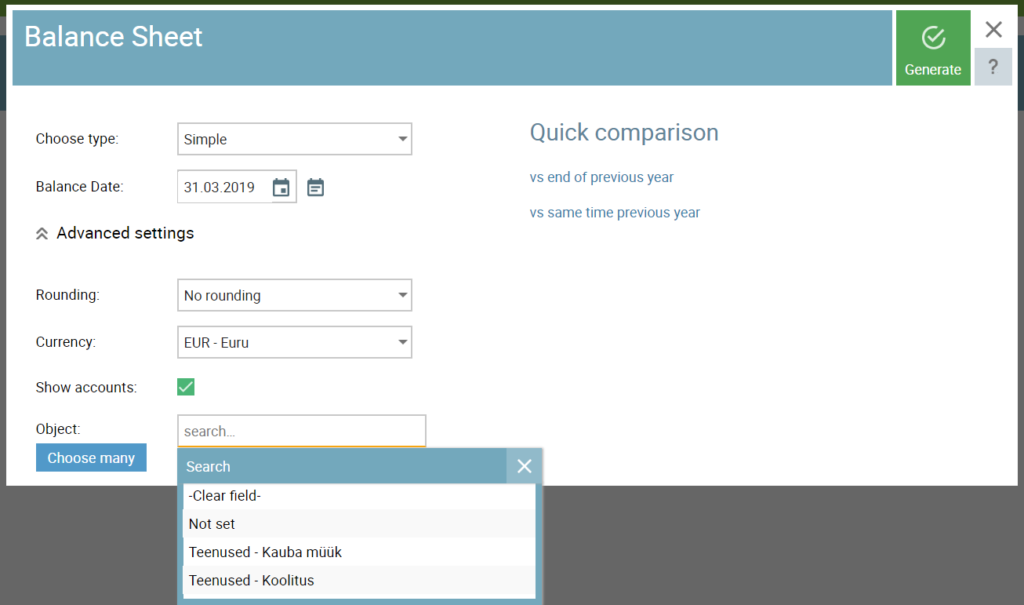

Financial reports can now be compiled with more than one object

To better meet the reporting needs of different clients financial reports can now be compiled for multiple objects at once.

Furthermore, you can now easily identify the rows that have no objects linked to them. This option is particluarly useful when you know that every purchase invoice row must have an object associated with it for example.

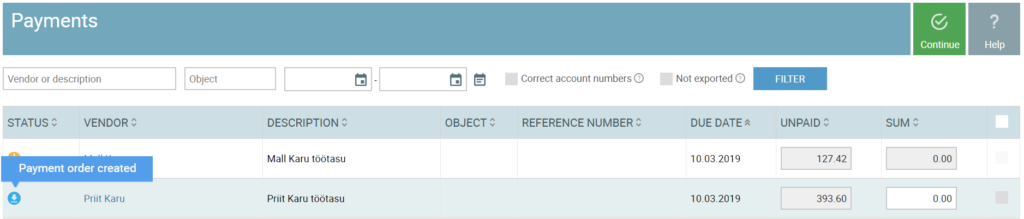

Better overview of payment orders sent to bank

There’s one more small but useful addition to point out. After you’ve created payment orders file, we mark the rows that have been exported with a special icon so that you can later easily identify purchase invoices already sent to the bank to be paid and see wich invoices still need your attention.

This feature is extremely useful if you are exporting purchase invoices with the future due date to the bank and are receiving new invoices all the time. Since exported rows are now separated from other rows there won’t be any double payments.

We hope you found some useful tips and information about the features we added for you in the latest release of SmartAccounts. It’s beginning to look like spring here in Estonia so be sure to enjoy it while it lasts. But if you do have any questions about SmartAccounts please don’t hesitate to contact us at info@smartaccounts.eu or call us (+372) 660 3303.