We´re delighted to announce that our December 2022 updates have arrived! This time our main focus has been on email safety and making sure emails get delivered to their intended destination. We´ve also implemented necessary changes regarding the income tax exemption and basic exception at retirement age (starting January 1, 2023).

The key features include:

- Changes in tax-free income rates from January 1, 2023

- Emails and option to set up your own SMTP server

- Export of goods

Tax-free income rate in 2023

From January 1, 2023, the general basic exemption rate will be 654 euros per month, i.e. 7848 euros per year. If the person’s gross income exceeds 1200 euros per month, i.e. 14 400 euros per year, the basic exemption rate starts to decrease and reaches zero at 2100 euros per month, i.e. annual income of 25 200 euros per year.

Basix exemption at retirement age

From January 1, 2023, a separate basic exemption will apply to people who have reached retirement age or will reach it during the calendar year, meaning that the average pension is exempt from income tax. The basic exemption during the retirement age is expected to be 704 euros per month, i.e. 8448 euros per year.

SmartAccounts is ready for changes

For people who will reach retirement age during the calendar year, the basic exemption of 704 euros per month will be applied automatically in SmartAccounts. For others, the general basic exemption of up to 654 euros per month will be applied automatically.

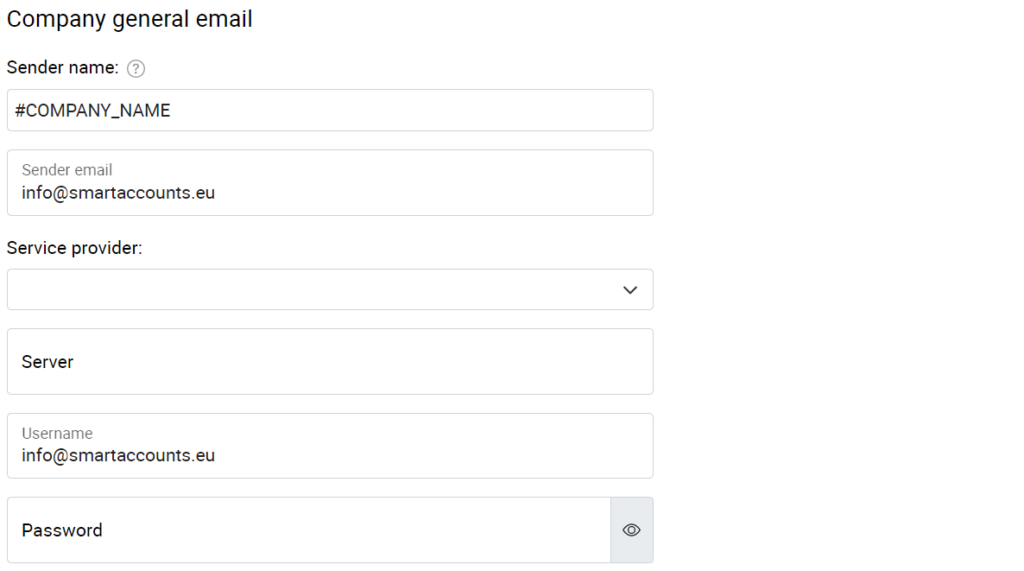

Set up your own SMTP server

We have created an opportunity to configure a custom SMTP server that will take care of the delivery of your emails in SmartAccounts. Next to the custom option it’s still also possible to use SmartAccounts’ server with a no-reply@smaccounts.eu address for email delivery.

After the update you’ll find 3 options under ´Settings´ – ´Email´ in the menu:

- SmartAccounts’ SMTP server. Emails are sent out using SmartAccounts’ SMTP server. The emails will have a ‘from’ address of no-reply@smaccounts.eu and a ‘reply to’ address you have set here as the sender email.

- An outside SMTP server. Emails are sent out using the SMTP server of your email service provider. That requires authentication with a username and password. Both the ‘from’ and ‘reply to’ addresses of the emails will be the address you have set here as the sender email.

- SmartAccounts’ SMTP server (old). Emails are sent out the old way using SmartAccounts’ SMTP server. This option cannot be relied upon because of modern junk mail rules and we will stop supporting this option soon. Therefore we recommend using your own SMTP server or the newer SmartAccounts’ SMTP server solution.

You can check the configurations under ´Settings´ – ´Emails´ in the menu.

Export of goods

We´re happy to announce that we have added automatic identification of exported goods. For exported goods transactions to reach the VAT return (row 3.2), the following conditions must be met while saving the invoice:

- Mark client country as non-EU country

- Mark item type as “product” or “warehouse” (‘PRODUCT’ või ‘WH’)

- Choose VAT rate 0%

- There is no need to fill the VAT number field of the client

What to do if a formula for finding exported goods is entered previously?

Users don’t have to worry about transactions reaching the VAT return in duplicate. If there is a formula set previously, it is automatically overwritten after the update in such a way that only transactions entered through ledger entries (´General ledger´ – ´General ledger entries´) and not invoices are included in the VAT return via the formula.

Other minor changes and fixes:

- The Item data card has a new field for internal notes. You can now add the necessary information for the internal use in your company.

- It’s now possible to filter clients and vendors by VAT number.

- You can now always see the active company in the upper right corner of the screen, even when larger documents are open.

- When sending payroll slips, only employees who receive payouts are displayed.

- Redundant zeros are removed from international reference numbers so that a match can be made with the reference number in our system.

- The employee data card now has the option “Don’t withhold unemployment insurance” instead of “Old age pensioner”. Use this option when the employee is an old-age pensioner, as well as in other cases where unemployment insurance payment should not be withheld from an employee’s salary (e.g. a sole proprietor, notary etc).

- We fixed a bug in the VAT return that caused imbalances in VAT related accounts when using VAT on imports.

- Payment orders under “Export of payment orders” in the menu have undergone a minor change. When the payment order file has been created and downloaded and the window is closed, the check marks are removed automatically from already processed rows.

- We fixed a bug in recurring invoices that generated invoices for past periods if you temporarily unchecked the automatic creation and sending of periodic invoices.

Have any questions or comments?

Contact us by email info@smartaccounts.eu or by phone 660 3303

May you have a joyous holiday season!