Initial balances

General ledger initial balances are necessary to build a complete picture of a company’s past transactions and current financial state. They have to be entered for both newly established companies and companies that have a previous history of accounting.

How to find the data

With new companies, you only have to know the date of establishment and the size of equity. For companies transferring over from another software, things are a bit more complicated.

The best place to find account balances in your old software is either the general ledger or the account turnover report. Just choose a date that is one day before you start using SmartAccounts for your day-to-day accounting.

If the chart of accounts in SmartAccounts doesn’t have an account you used in your previous software, you have two options:

- Choose an alternative similar account.

- Add the missing account to SmartAccounts.

While doing so is recommended, you don’t necessarily have to enter the initial balances before you start your accounting in SmartAccounts. It must be noted that initial balances are needed for financial reports like the balance sheet and the income statement to be correct.

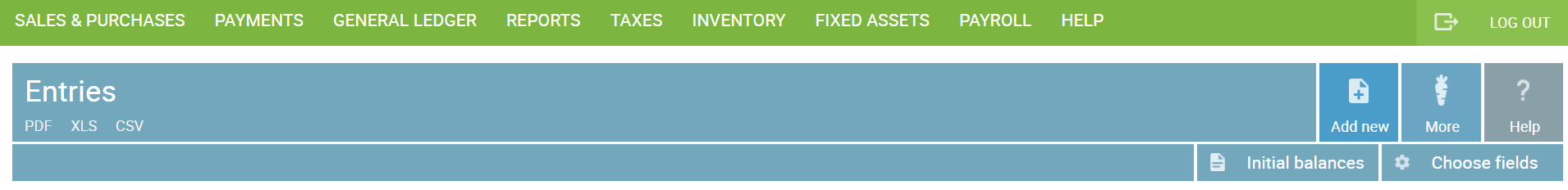

Entering initial balances in SmartAccounts is easy. You can do that by selecting ‘General ledger’ – ‘General ledger entries’ – ‘More’ – ‘Initial balances’ from the SmartAccounts menu.

First choose between 3 options:

- your company has been recently established without contribution

- your company has been recently established with monetary contribution

- your company has a previous accounting history and you are transferring over from another software

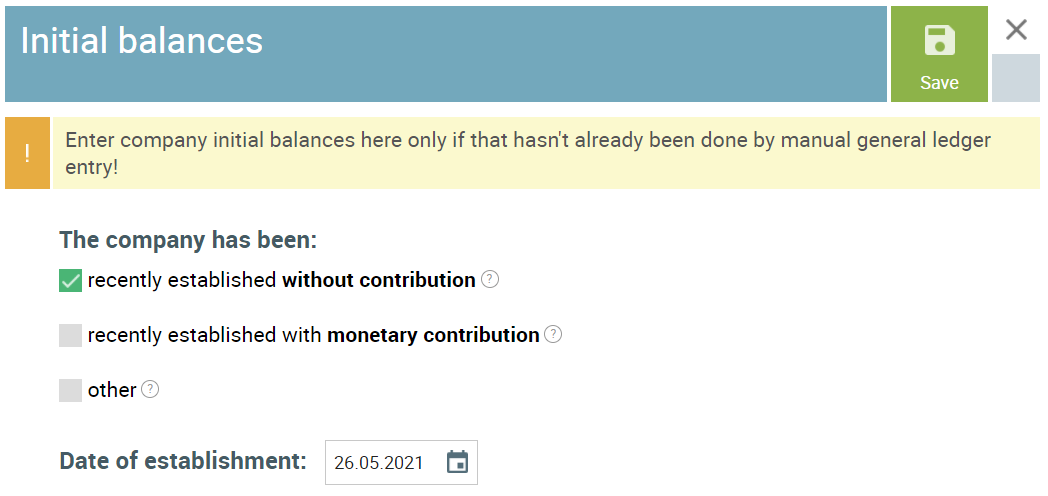

Did you establish your company without contribution?

- choose the first option

- enter the date your company was established

- save

An automatic general ledger entry about establishing the company without contribution is created. It can be found under ‘General ledger’ – ‘General ledger entries’ – ‘More’ – ‘Initial balances’ in the SmartAccounts menu.

Did you establish yor company with monetary contribution?

- choose the second option

- enter the date your company was established

- save

An automatic general ledger entry about establishing the company with monetary contribution is created. It can be found under ‘General ledger’ – ‘General ledger entries’ – ‘More’ – ‘Initial balances’ in the SmartAccounts menu.

Does your company have a previous accounting history?

If your company has a previous accounting history, choose the last option.

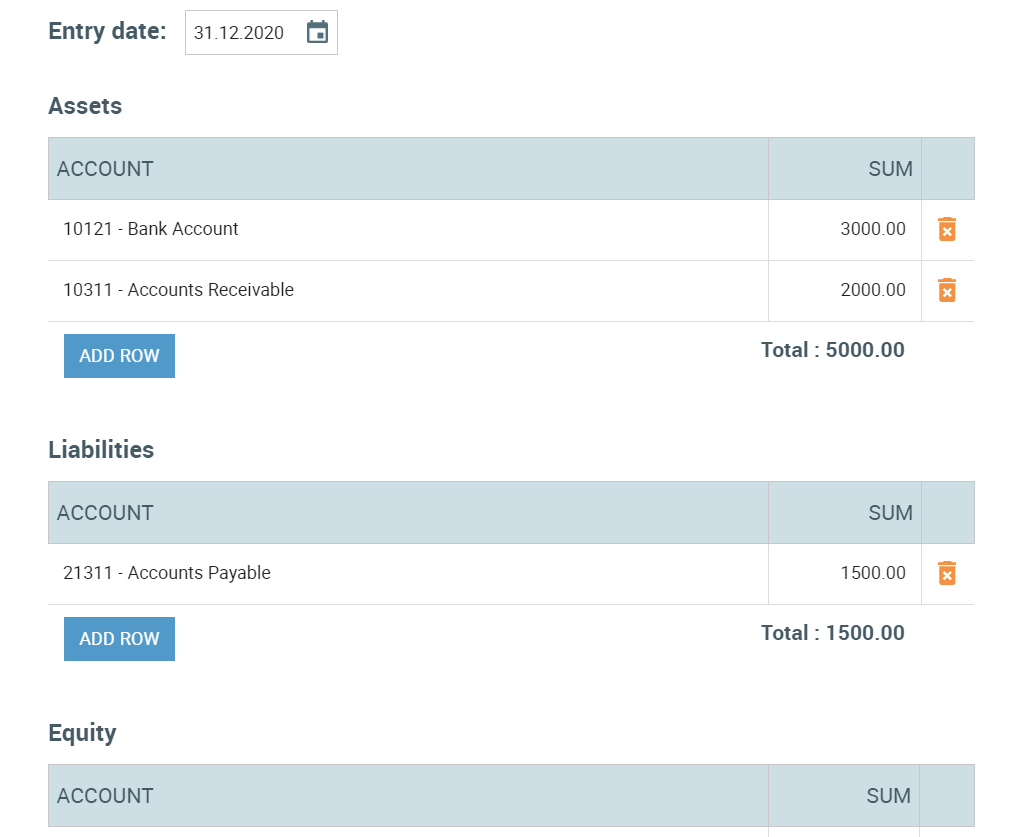

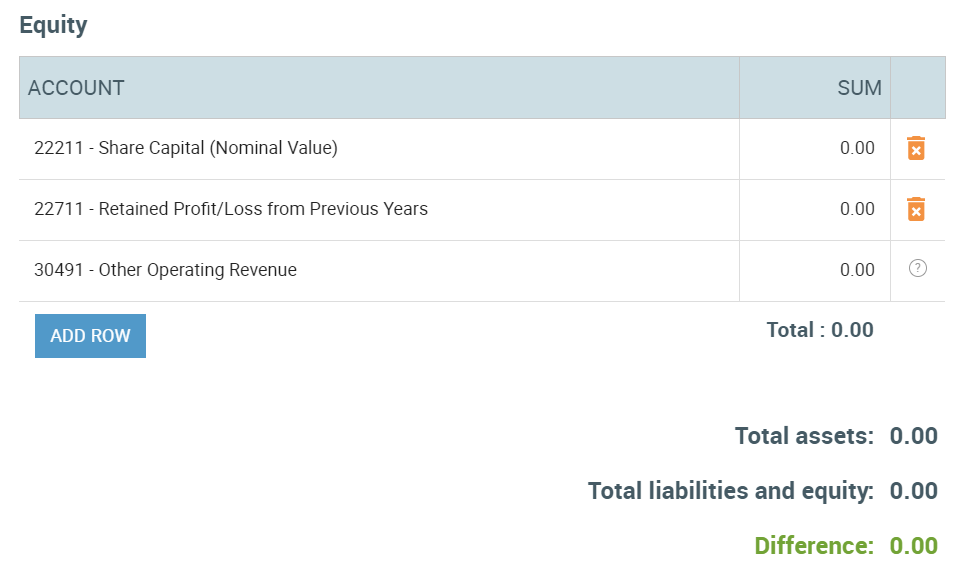

You will then see a form that is divided into 3 sections::

- assets

- liabilities

- equity

Adding new rows

Enter the balance of every account you use in your accounting. You may add additional rows to a section by clicking on the ‘Add row’ button located underneath every section

You can then search for and select an existing account or add a totally new account to your chart of accounts.

Entry date

Set the entry date to a date that is one day before you start using SmartAccounts for your day-to-day accounting.

For example, if you start using SmartAccounts from the beginning of the calendar year, set the entry date to the 31st of December of the previous year.

Profit/loss from the financial year

SmartAccounts calculates the current period profit or loss automatically and therefore using the ‘Profit/loss for financial year’ account in your initial balances is not possible. Therefore you can enter your current period profit or loss on any income or expense account.

By default the equity section of the form already uses the other operating revenue account for that purpose.

Once all the values have been entered the entry must be in balance and the difference 0.00.

Initial balances in the middle of the year

You can also start using SmartAccounts in the middle of the financial year. In that case it would be reasonable to enter the initial balances of all income and expense accounts instead of just the one profit or loss row. This enables you to generate detailed financial statements for the financial year in SmartAccounts.

The income and expense account balances should be added to the liabilities section, keeping in mind to:

- enter income account balances with a positive value

- enter expense account balances with a negative value

Initial balances with a manual general ledger entry

You may alternatively enter your initial balances with a regular manual general ledger entry that has a row for every account with a non-zero balance. To do that, select ‘General ledger’ – ‘General ledger entries’ from the SmartAccounts menu and click on ‘Add new’ on the toolbar.

Initial balances with a manual general ledger entry in the middle of the year

If you start using SmartAccounts in the middle of the year and wish to enter your initial balances with a manual general ledger entry, enter the initial balances of all income and expense accounts instead of just the one profit or loss row.

This enables you to generate detailed financial statements for the financial year in SmartAccounts.

Initial balances of clients and vendors

Purchases

If you want to link initial balances to vendors, it’s recommended to enter accounts payable balances as purchase invoices. This can be done as one aggregate invoice or several separate invoices. If keeping track of different payment due dates is important, separate invoices are the way to go.

To prevent these purchase invoices from changing the general initial balances, it’s recommended to:

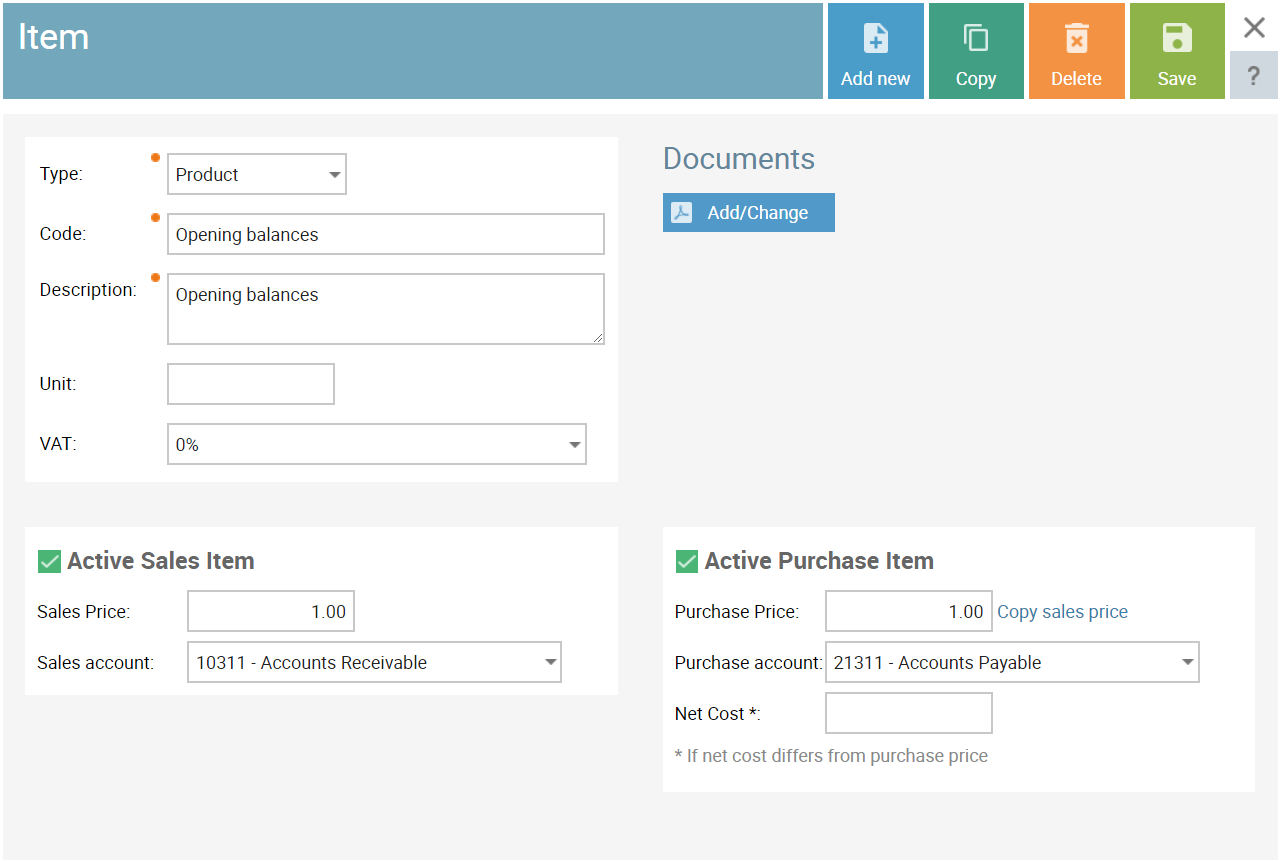

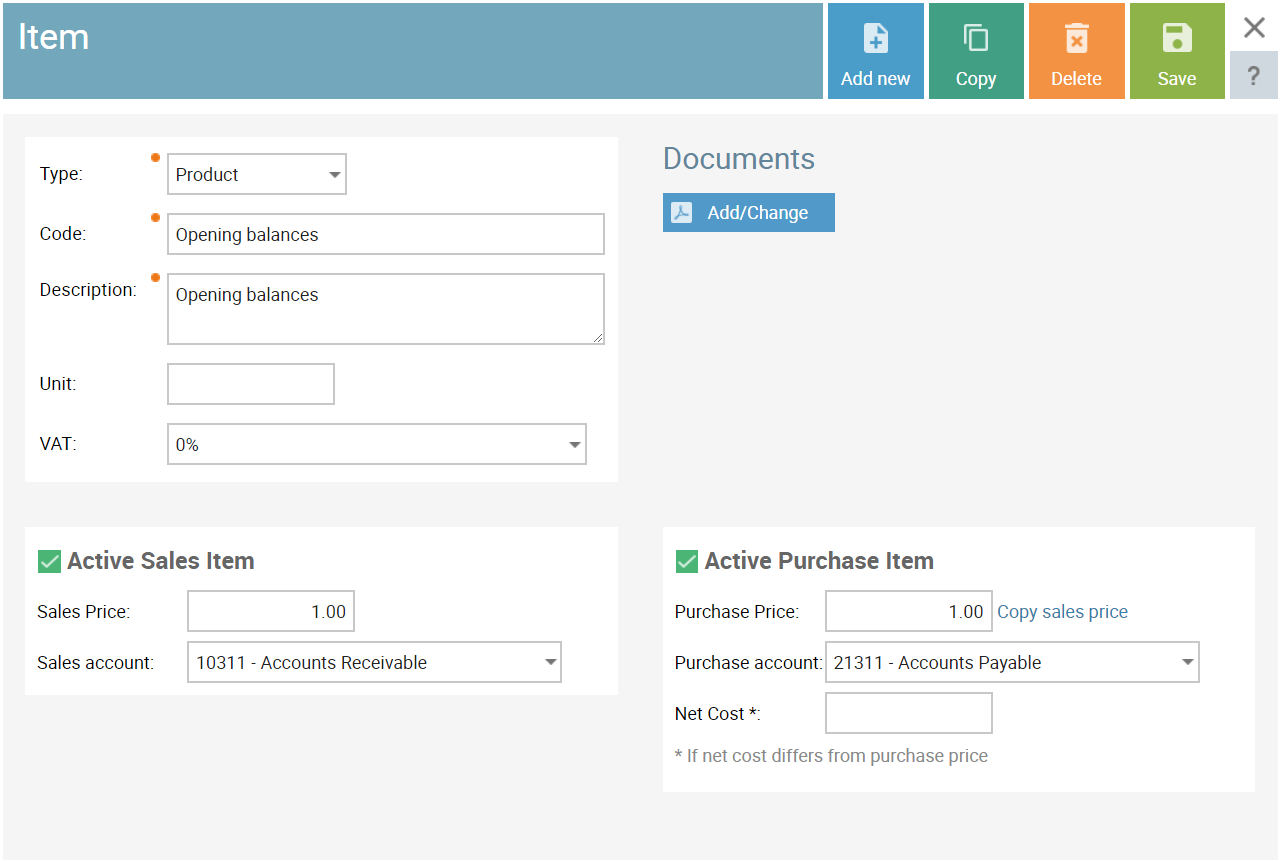

- add a new item with the description ‘Initial balances’ from ‘Sales & purchases’ – ‘Items’ – ‘Add new’,

- change it’s VAT value to 0%,

- change its sales account to ‘Accounts receivable’ and its purchase account to ‘Accounts payable’. That way you can use the same item for both client and vendor balances,

- add a new purchase invoice from ‘Sales & purchases’ – ‘Purchase invoices’ – ‘Add new’. Select the desired vendor, enter the invoice date (same as initial balances i.e. 1 day before starting to use SmartAccounts), invoice number and due date,

- choose the ‘Initial balances’ article on the first invoice row and set the row price to the vendor balance,

- save the invoice,

- repeat steps 4 to 6 for all vendors.

- you can see from the general ledger that the ‘Accounts payable’ account has been debited and credited by the purchase invoices in the same amount. So the only permanent change in the account has been made by the initial balances general ledger entry.

Sales

Sales invoice initial balances are nearly identical to purchase invoice initial balances. After you create the ‘Initial balances’ item as described in steps 1 to 3 in the previous section:

- add a new sales invoice from ‘Sales & purchases’ – ‘Sales invoices’ – ‘Add new’. Select the desired client, enter the invoice date (same as initial balances i.e. 1 day before starting to use SmartAccounts) and due date. You can change the invoice number after the invoice has been saved,

- choose the ‘Initial balances’ article on the first invoice row and set the row price to the client balance,

- save the invoice,

- repeat steps 1 to 3 for all clients.

Inventory initial balances

To link initial balances to different warehouse items:

- enter a new incoming warehouse movement with the same as initial balances i.e. 1 day before starting to use SmartAccounts from ‘Inventory’ – ‘Warehouse movements’ – ‘Add new’.

- use real warehouse items (not the ‘Initial balances’ item like in invoices) and enter their quantities and prices,

- to prevent the warehouse movement from creating double balances, change the row account manually to ‘Inventory’.

- Once you save, the following automatic general ledger entry is created:

Debit: Inventory

Credit: Inventory

Foreign currency bank account balances

To enter foreign currency bank account balances:

- enter the balance of the account in euros with the general initial balances entry.

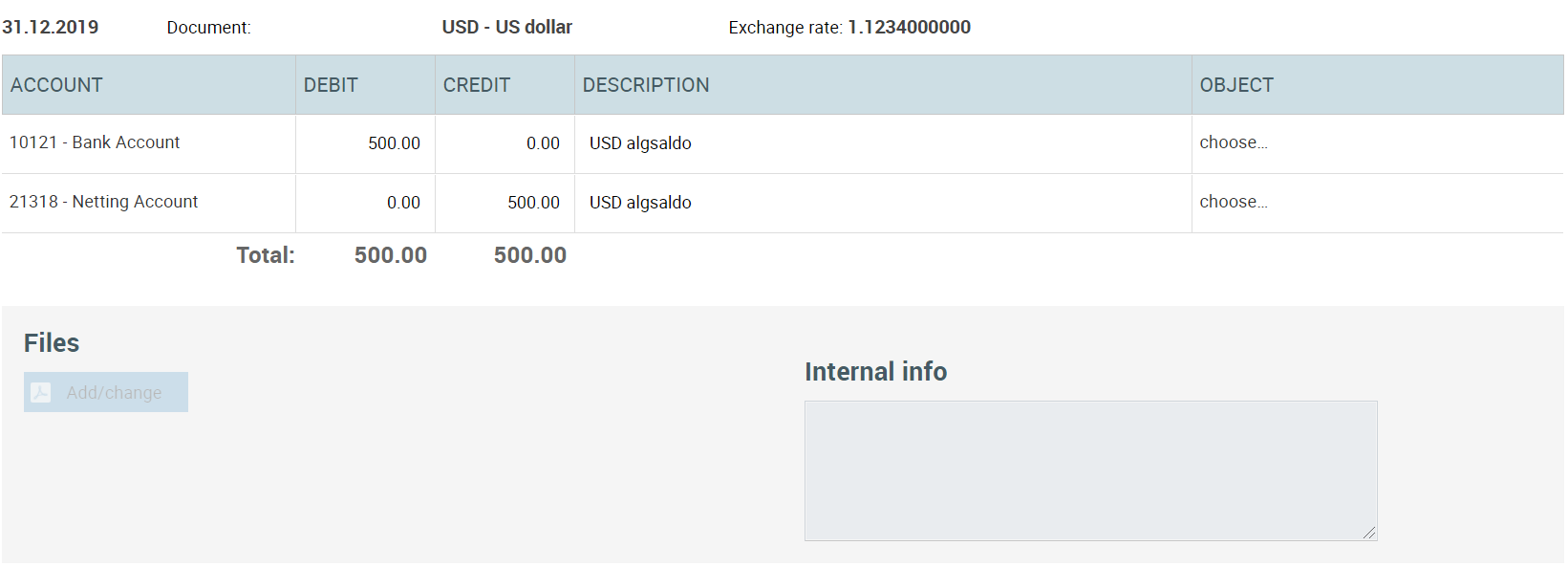

- after the initial balances entry in euros has been saved, add an entry for every different foreign currency from ‘General ledger’ – ‘General ledger entries’ – ‘Add new’ that has the following values:

-

- the initial balances date as the entry date,

- the foreign currency as the entry currency,

- Debit: Bank account; Credit: Netting account (21318),

- the debit and credit sums in the foreign currency,

-

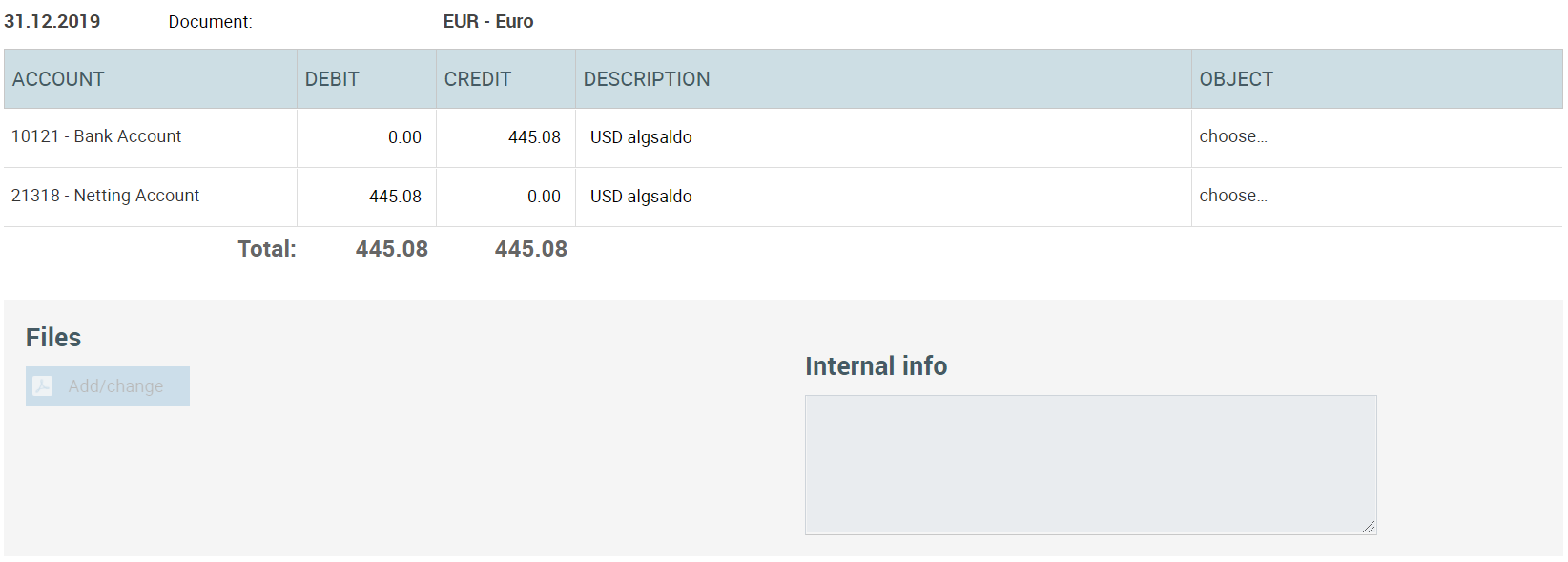

- after that, enter another manual general ledger entry so that the foreign currency one does not affect the initial balance of the general ledger account:

-

-

-

- the initial balances date as the entry date,

- euro as the entry currency,

- Debit: Netting account (21318); Credit: bank account,

- the debit and credit sums converted into euros,

-

-

-

These two entries combined will create a situation where the foreign currency bank account has the right balance both in euros and in its set currency. A similar pair of entries must be created for every currency or foreign currency bank account.

Below is a print screen of the configuration for the conversion balance item.

Plese notice:

- VAT: 0%

- Sales account: Accounts Receivable

- Purchase account: Accounts Payable