From January 1st 2018 the overall tax-free amount (basic exemption) of 6000 euros per year or 500 euros per month will be applied on all types of income and the increased basic exemption on pension and compensation for accident at work are not applicable anymore.

The basic rules for 2018 are:

- annual income up to 14 400 euros amounts to 6000 euros as annual basic exemption

- if the worker’s annual income is between 14 400 euros to 25 200 euros, basic exemption decreases according to the following formula: 6000 – 6000 ÷ 10 800 × (income amount – 14 400)

- if annual income is more than 25 200 euros, basic exemption is 0.

Deduction of Tax-Free Income

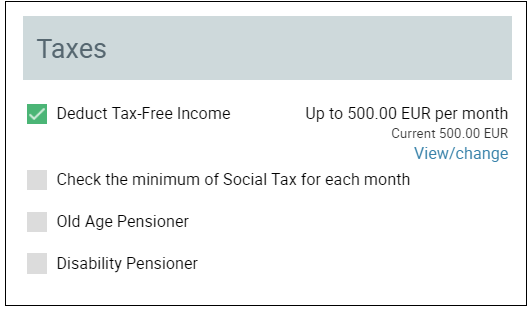

There are 3 ways you can configure the worker’s income taxation in SmartAccounts.Open Payroll – Workers and you’ll find the following configuration options for every worker:

- Do Not Deduct Tax-Free Income (box “Deduct Tax-Free Income is unchecked)

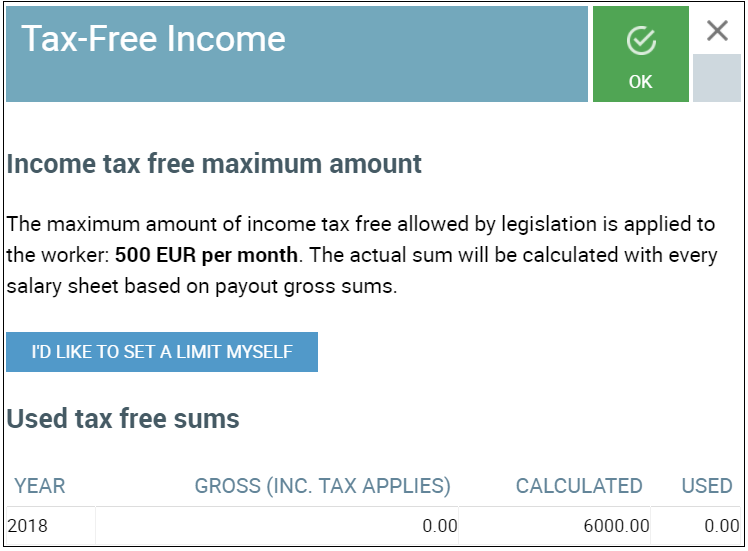

- Deduct Tax-Free Income (maximum amount of income tax-free allowed by legislation will be applied to the worker)

- Deduct Tax-Free Income (set a limit yourself)

Application for Deduction of Tax-Free Income

✔ By default the maximum amount of income tax-free allowed by legislation will be applied to the worker (provided that “Deduct Tax-Free Income” is checked) from January 1st 2018.

✔ If the person in question has filed an application for using a specific amount of tax free income it should be specified as a fixed amount.

✔ SmartAccounts takes into account the settings on employee card but calculates the actual sum with every salary sheet based on payout gross sums.

✔ You can find the information about used tax-free sums and gross sums on employee card (“Used tax free sums”).

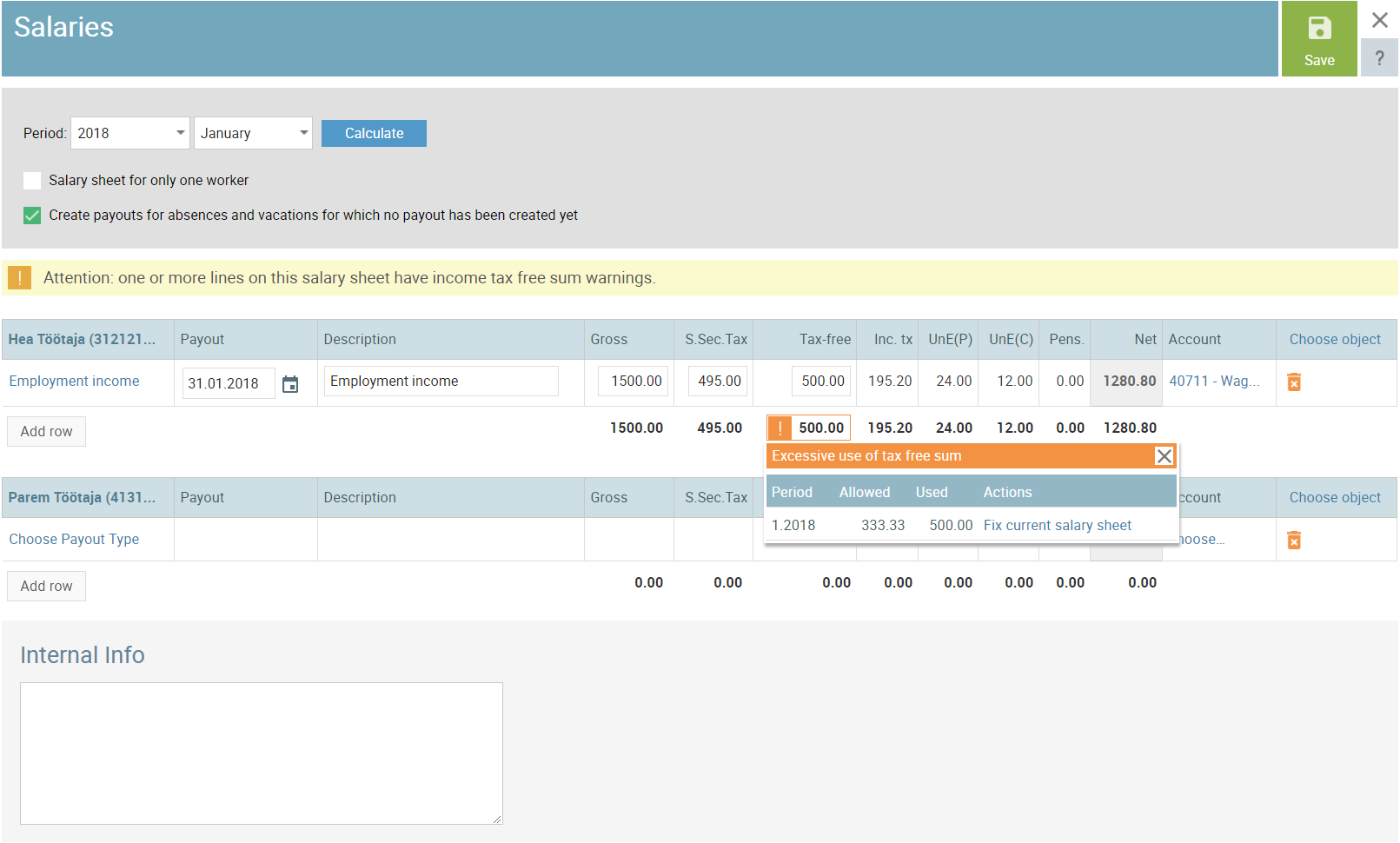

✔ In case of excessive use of tax-free sum in one specific month, a warning will be displayed with the instructions on how to correct it. Seeing this warning from time to time is actually normal with the new rules of tax free income deduction. This is because every new payout in one specific month changes the overall gross amount for that specific month and so it might also change the tax free amount allowed in that month and also the net sums.

For example if the worker has a fixed income of 1200 euros he or she might use 500 euros income tax free every month. If the worker decides to have a vacation the additional payment made in the same month changes the tax free amount allowed for that month. If for example the additional payment for the vacation will be 300€ the total gross sum for that month amounts to 1500€ and the income tax free sum can now be 333.33 euros at most. But 500 € tax free has already been applied with the first salary sheet which now also needs to be corrected. And if the net sum has been paid out to the worker as well the bank payment needs changing as well.