Fixed asset registration

Registering a fixed asset with a purchase invoice

To purchase a fixed asset, create a new purchase invoice (‘Sales & purchases’ – ‘Purchase invoices’- ‘Add new’) and choose the fixed asset account of the right fixed asset group (‘Fixed assets’ – ‘Fixed asset settings’ – ‘Fixed asset groups’) on at least one of the invoice’s rows.

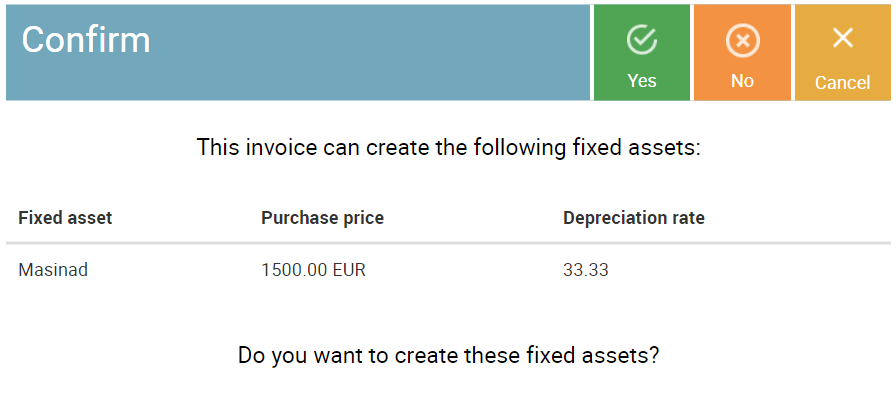

Once all the data is entered correctly the invoice can be saved. During the saving process a pop-up dialog is displayed where you can confirm the registration of new fixed assets:

- If you press ‘Yes’ – the invoice is saved and the new fixed assets are registered;

- If you press ‘No’ – the invoice is saved but no fixed assets are registered.

- If you press ‘Cancel’ – the whole saving process is aborted.

You can manage registered fixed assets by selecting ‘Fixed assets’ – ‘Fixed assets’ from the menu.

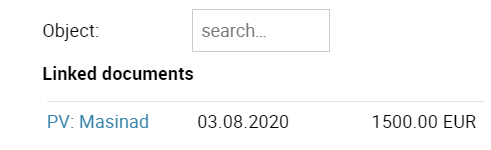

Fixed asset charts connected to the purchase invoice can also

Fixed asset charts connected to the purchase invoice can also

be accessed by clicking on the right link (with the PV-prefix) from the invoice’s ‘Linked documents’ section.

Registering a fixed asset without a purchase invoice

If you have fixed assets that have been acquired earlier or that don’t have purchase invoices (manual general ledger entry), you can register them by pressing ‘Add new’ in ‘Fixed assets’ – ‘Fixed assets’.

It must be noted that this just creates a new fixed asset chart but doesn’t create any general ledger entries.

Read more about the fixed assets

Fixed asset registration