Fixed asset additions

Fixed asset additions are expenses added to the purchase price of the asset made after it’s initial purchase (if they meet the definition of fixed assets and the criteria of appearing on the balance sheet).

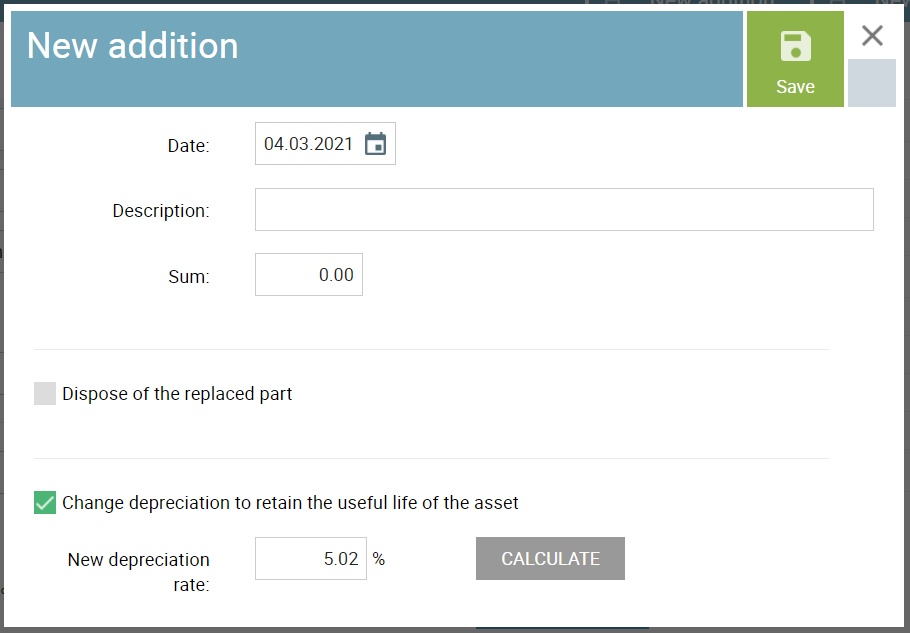

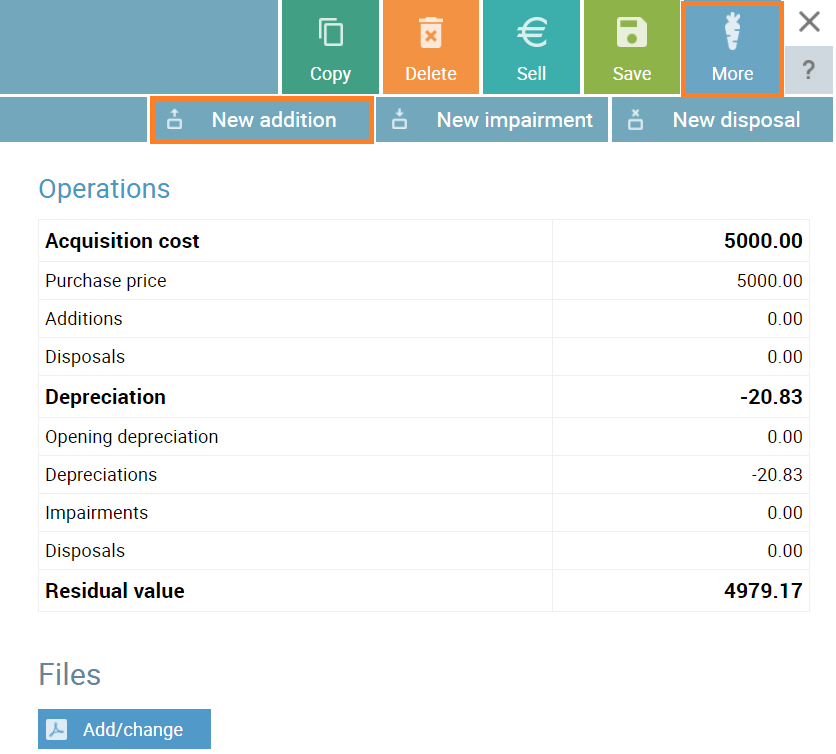

You can add a new addition by selecting ‘More’ – ‘New addition’ from the toolbar of the fixed asset chart.

Filling the description field is optional but you have to enter a sum for the addition and choose whether the useful life of the asset changes or stays the same.

Disposal of replaced parts

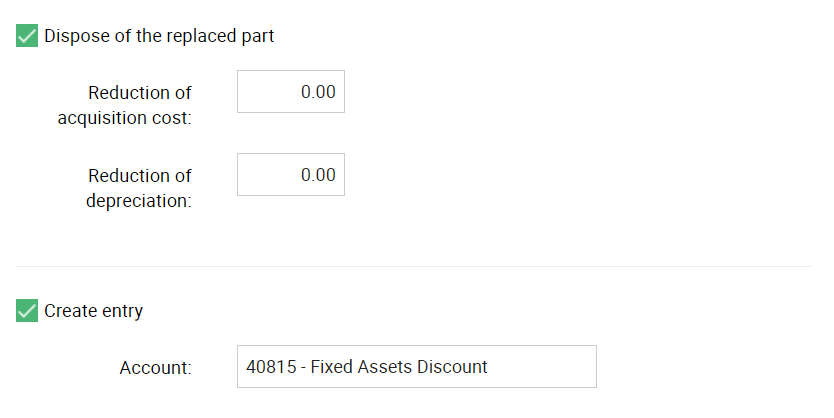

Check the ‘Dispose of the replaced part’ option if you wish to do so.

You then have to enter a reduction amount for both the acquisition cost and depreciation of the asset.

If you check the ‘Create entry’ option, an automatic general ledger entry is created for the disposal. The ‘Fixed asset impairment and disposal account’ selected in fixed asset setting is used by default.

You can see the automatic general ledger entry by selecting ‘More’ – ‘Open entry’ from the toolbar of the saved fixed asset operation.

If an entry is not created, the acquisition cost and depreciation is reduced on the fixed asset chart but these changes won’t be reflected on the balance sheet.

The useful life of the asset

If you check the “Change depreciation rate to retain the useful life of the asset” option, a new depreciation rate is calculated automatically for the asset that achieves that goal.

If this box is unchecked the depreciation rate stays the same and the asset will depreciate slower.

You can see the asset’s different historical depreciation rates on the fixed asset chart.

Fixed asset additions